Navigating the complexities of a denied car insurance claim can be daunting. In this guide, we delve into the common reasons for denial, steps to appeal, the role of legal assistance, understanding policy details, and preventive measures to safeguard your claims.

Let’s uncover the intricacies together.

Understanding a Denied Car Insurance Claim

When your car insurance claim is denied, it can be frustrating and confusing. It’s important to understand the common reasons for a denied claim, the steps you can take to address it, and the documentation needed to support your claim.

Common Reasons for a Denied Car Insurance Claim

- Failure to disclose accurate information on the policy application.

- Policy exclusions that apply to the specific situation.

- Missed premium payments or lapsed coverage.

Steps to Take When Your Car Insurance Claim is Denied

- Contact your insurance company to understand the reason for denial.

- Review your policy documents to verify coverage details.

- Provide additional documentation or evidence to support your claim.

- Consider filing an appeal if you believe the denial was unjustified.

Examples of Documentation Required for a Car Insurance Claim

- Police report for accidents or theft.

- Medical records for injuries sustained in a car accident.

- Vehicle repair estimates or invoices for damages.

Appealing a Denied Car Insurance Claim

Appealing a denied car insurance claim can be a complex process, but it is crucial if you believe you have a valid claim that was unjustly denied. Understanding the steps involved in appealing a denial can help you navigate the process effectively.

Direct Appeal to Insurance Company vs. Legal Channels

When appealing a denied car insurance claim, you have the option to appeal directly to the insurance company or seek legal assistance.

- Direct Appeal: If you choose to appeal directly to the insurance company, you will need to follow their specific appeals process. This typically involves submitting additional documentation or evidence to support your claim.

- Legal Channels: Seeking legal assistance involves hiring a lawyer who specializes in insurance claims. They can help you navigate the legal system, gather necessary evidence, and represent you in court if needed.

Importance of Timing

Timing is crucial when appealing a denied car insurance claim. Insurance companies often have strict deadlines for appeals, so it is essential to act quickly.

- Submit your appeal within the specified timeframe to ensure it is considered.

- Delaying the appeal process can result in further complications or even a loss of your right to appeal.

Seeking Legal Assistance

When faced with a denied car insurance claim, seeking legal assistance may become necessary to navigate the complexities of the situation and ensure that your rights are protected.

Reasons for Seeking Legal Assistance:

- Interpreting Legal Terms: Legal professionals can help you understand the intricacies of your insurance policy and the legal terms involved in the denial of your claim.

- Negotiation Skills: Lawyers have the expertise to negotiate with insurance companies on your behalf to reach a fair settlement.

- Lawsuit Representation: In cases where a lawsuit needs to be filed against the insurance company, a lawyer can provide representation in court.

Examples of Situations Benefiting from Legal Help:

- Disputes over Coverage: If the insurance company denies coverage that you believe you are entitled to under your policy.

- Bad Faith Claims: When the insurance company acts in bad faith by unreasonably denying or delaying your claim.

- Complex Claims: For claims involving multiple parties, injuries, or extensive damages, legal assistance can be invaluable.

Role of a Lawyer in Handling a Denied Car Insurance Claim:

- Investigation: A lawyer can conduct a thorough investigation into the denial of your claim and gather evidence to support your case.

- Negotiation: Lawyers can negotiate with the insurance company to try to settle the claim without resorting to litigation.

- Litigation: If necessary, a lawyer can represent you in court and advocate for your rights in a lawsuit against the insurance company.

Understanding Insurance Policy Details

When dealing with a denied car insurance claim, it is crucial to thoroughly review your insurance policy details. Understanding the fine print of your policy can make a significant difference in how you approach the situation and potentially avoid claim denials in the future.

Importance of Reviewing Policy Details

- Reviewing your insurance policy helps you understand the coverage you have and the limitations of your policy.

- It allows you to identify any exclusions or conditions that may have led to the denial of your claim.

- Knowing your policy details can help you make informed decisions when purchasing insurance and avoid misunderstandings in the event of a claim.

Tips for Understanding Policy Fine Print

- Read through your policy carefully and take note of any terms or language that may be unclear.

- Ask your insurance provider or agent to explain any sections of the policy that you find confusing.

- Pay attention to definitions, coverage limits, deductibles, and any specific conditions that may apply to your policy.

Impact of Policy Limits and Coverage Types on Denied Claims

- Policy limits determine the maximum amount your insurance company will pay for a covered claim. Exceeding these limits can result in a denied claim.

- Certain coverage types, such as comprehensive or collision coverage, may be necessary to protect against specific risks. Without the right coverage, your claim could be denied.

- Understanding the relationship between your policy limits, coverage types, and the circumstances of your claim can help you navigate the claims process more effectively.

Preventing Denied Car Insurance Claims

Preventing denied car insurance claims is crucial to avoid financial setbacks and ensure smooth claim processing. By taking proactive measures and maintaining updated information, you can reduce the risk of claim denials.

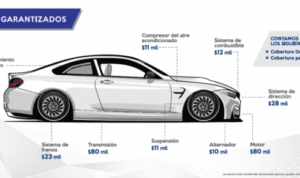

Regular Maintenance and Safe Driving Habits

Regular maintenance of your vehicle not only ensures its optimal performance but also plays a significant role in preventing accidents. By keeping your car in good condition and following safe driving practices, you can reduce the likelihood of filing a claim due to preventable accidents.

Updating Information with the Insurance Company

One common reason for claim denials is outdated or inaccurate information provided to the insurance company. It is essential to regularly review and update your policy details, such as changes in address, vehicle ownership, or drivers listed on the policy.

By ensuring that your information is up to date, you can avoid claim denials that may arise from discrepancies.

Closure

In conclusion, knowing what to do when faced with a denied car insurance claim is crucial. By following the steps Artikeld in this guide, you can better equip yourself to handle such situations effectively and protect your interests. Remember, knowledge is key in the world of insurance claims.

General Inquiries

What should I do if my car insurance claim is denied?

If your claim is denied, gather all relevant documentation, review your policy details, consider appealing the decision, and seek legal assistance if needed.

How can I prevent my car insurance claims from being denied in the future?

To prevent denials, maintain your vehicle regularly, practice safe driving habits, and ensure your information with the insurance company is up to date.